December 2025: The One Housing Metric that Tells You Everything (but Nobody is Talking About)

- December 2, 2025

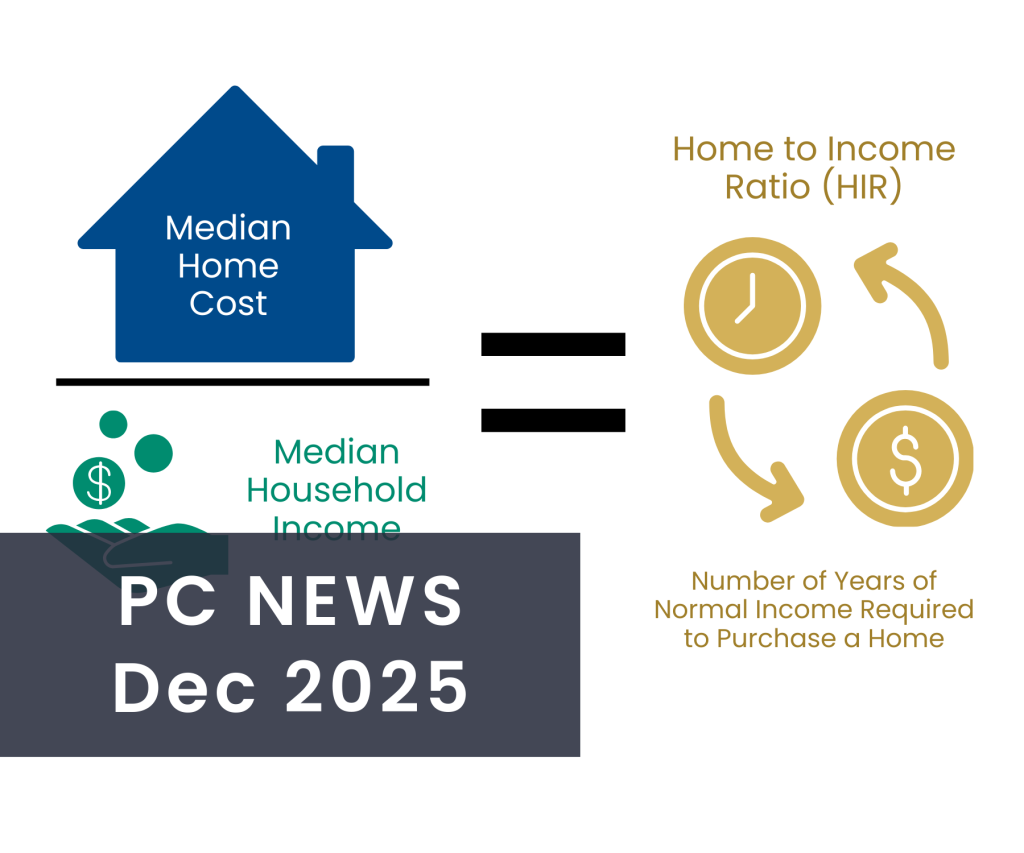

The world of housing market analysis is rife with acronyms and overspecialized jargon; cost burdens, AMIs, and the list goes on. Awash in these terms, it seems we have lost track of the fundamental market questions. The average human being considering the housing market probably cares less about the term ‘AMI’ and much more about this fundamental question: in a given market, how far will a person’s dollar go if they are looking to buy a market-rate home? To answer this question, Points Consulting has adopted a simple metric we are calling the Home to Income Ratio (or HIR), which is the ratio of median home price to median household income. An easily intelligible short-hand definition is: how many years of income does an average household need in order to purchase an average priced home?

This ratio intentionally leaves out all the factors that keep mortgage brokers in business (such as credit scores, collateral, debt-to-income ratio, etc.). These are all necessary steps when a particular household is looking at a particular home, but none of these factors can be abstracted for all households in a particular market. With HIR, not only can we compare different markets to each other, but also the same market across time. HIR answers questions like: is it more affordable to aim for a house in your existing market with your existing job, or is it better to move to a more affordable County to accept a slightly lower wage job? Or, has the market in your County become more or less affordable since 2019?

In short, the beauty of HIR is its simplicity and explaining power. But, to make it even sweeter, we are giving these data away for free! If you sign up for our newsletter, you can download our spreadsheet with HIR for 3,000+ Counties and county equivalents in the United States.1

Regional, State & County Level Results

In this post and the aforementioned spreadsheet, we are looking at HIR values by state and County based on 2025 values as well as market values as of 2019. Though it would scratch that symmetrical itch to look at a five-year period, let us just say that 2020 was a rather atypical year for housing prices in the U.S., warranting the decision to nudge the initial period back by one extra year.

So, without further ado, here are the results. And, if you are a person who would rather look at maps than tables, check out the handy County level heat map shown here.

HIR Results by Census Geographic Division

There are certain regional characteristics to the housing market, which is why in this first cut we focus on “the forest” rather than “the trees.” We separated the United States into nine multi-state Divisions as shown in Figure 1. These are based on Census divisions, but we changed the names to make them easier to interpret.2 Recognizing that there is variation within each Division, we are also providing several additional metrics.

Table 1 displays the proportion of Counties in the Division that are in the 80th percentile of all Counties for HIR (in other words, the least affordable places in the Country). And, just to bring it home with place names you may recognize, we are naming the five Counties with the highest HIR in each Division.3

Right now, an average household in the United States needs roughly five years and four months of income to buy an average-priced home (HIR of 5.31). If you were aiming to buy a house in 2019 but did not achieve that goal until 2025, you are now seven months worse off. In certain geographic areas you may be able to purchase a home with less than five years of normal income, namely, the Great Lakes, the North Plains, and the Inland Gulf. The three most challenging Census Divisions include the Pacific West, New England, and the Mountain West, all of which require six to eight years of regular income. In every Census Division, the average household is more challenged than it was six years ago, but New England takes home the “tough and getting tougher” award. Its current HIR of 6.87 increased 1.14 over that period (equivalent to 1 year and almost two months). Interestingly, most remaining Divisions touching the East Coast and Gulf saw the least dramatic changes in conditions (the Mid Atlantic, South Atlantic, and Inland Gulf). Each saw HIR increases by five months or less.

The proportion of Counties at or above the 80th percentile corresponds pretty linearly with the current HIR. In the Pacific West, almost 7 out of 10 counties rank as the least affordable in the Country. On the opposite side of the scale, among Great Lakes states, only a handful approach that undesirable threshold.

HIR Results by State

Table 2 displays most of the same statistics, but as the geographic scope narrows, one new statistic is added to the pot that helps accentuate what we can call the “gazelle” counties which saw dramatic increases in HIR in the past six years. Technically, these are Counties which saw a 50% or greater increase in HIR. To keep this table brief, just the top and bottom five states by HIR are displayed, but the full results can be seen in the full spreadsheet.

The list of states with highest HIR includes, not surprisingly, New York, California, Hawaii, and Massachusetts. But, with a stunning HIR of 8.52, the Big Sky state ranks first, serving as poster-boy for post-COVID price gentrification (not to mention the Kevin Costner effect).5 Alternatively, states where a middle-class family gets the biggest bang for their buck include Pennsylvania, Ohio, Kansas, Illinois and, most of all, Iowa (HIR of 3.79). Even these economical states show some reversion to the mean of unaffordability, as exemplified by the fact that nearly 25% of counties in Kansas and 13% in Iowa are in the gazelle category.

Figure 1: Map of U.S. Regions

Source: Points Consulting using U.S. Census Bureau Region Divisions

Table 1: HIR 2025 with Past 6-Years Change

| Geography | 2025 Median HIR | Change in HIR (’19 to ’25) | Proportion of Counties in the 80th Percentile | Top 5 Least Affordable Counties (Above 1,000 Population) |

|---|---|---|---|---|

| United States | 5.31 | 0.59 | 20.0% | See Below |

| Pacific West | 8.35 | 0.40 | 68.8% | Santa County, CA Monterey County, CA Orange County, CA Santa Cru Barbara z County, CA Napa County, CA |

| New England | 6.87 | 1.14 | 64.4% | Newport County, RI Barnstable County, MA Suffolk County, MA Washington County, RI Bristol County, MA |

| Mountain West | 6.29 | 0.65 | 51.4% | Kootenai County, ID Santa Fe County, NM Gallatin County, MT Boulder County, CO Washoe County, NV |

| Mid-Atlantic | 5.89 | 0.13 | 15.3% | New York County, NY Cape May County, NJ Rockland County, NY Queens County, NY Richmond County, NY |

| South Atlantic | 5.25 | 0.37 | 22.5% | Monroe County, FL Chatham County, NC Charleston County, SC Collier County, FL Albemarle County, VA |

| Mid-South | 5.11 | 0.84 | 21.5% | Williamson County, TN Baldwin County, AL Wilson County, TN Maury County, TN Rutherford County, TN |

| Inland Gulf | 4.58 | 0.25 | 10.2% | Travis County, TX Parker County, TX Benton County, AR Hays County, TX Bastrop County, TX |

| North Plains | 4.25 | 0.67 | 3.5% | Platte County, MO Johnson County, KS Burleigh County, ND Olmsted County, MN Cass County, MO |

| Great Lakes | 4.10 | 0.61 | 5.9% | Allegan County, MI Grand Traverse County, MI Walworth County, WI Ozaukee County, WI Washtenaw County, MI |

Source: Points Consulting, HIR 20254

Table 2: 2025 HIR Results by State

| Rank among States | State Name | Statewide HIR 2025 | Change in HIR ('19 to '25) | Proportion of Counties in the 80th Percentile | Percentage of “Gazelle” Counties (>=50% increase in HIR) |

|---|---|---|---|---|---|

| 1 | Montana | 8.52 | 2.34 | 71.3% | 32.9% |

| 2 | New York | 7.79 | 1.29 | 69.3% | 4.4% |

| 3 | California | 7.55 | 0.34 | 88.4% | 0.0% |

| 4 | Hawaii | 7.52 | (0.69) | 100.0% | 0.0% |

| 5 | Massachusetts | 7.44 | 1.39 | 81.1% | 3.3% |

| 46 | Pennsylvania | 4.17 | 0.64 | 0.0% | 8.5% |

| 47 | Ohio | 4.00 | 0.83 | 0.3% | 10.8% |

| 48 | Kansas | 3.96 | 0.83 | 0.0% | 24.5% |

| 49 | Illinois | 3.83 | 0.21 | 0.0% | 4.8% |

| 50 | Iowa | 3.79 | 0.51 | 0.7% | 13.4% |

Source: Points Consulting, HIR 2025

HIR Results: Least Affordable Counties

Readers will find the most interesting trends for their vicinity using both the heatmap and the spreadsheet. Here (in Tables 3 and 4 below) we focus on the top 20 and bottom 20 counties in the country in 2025, while also showing the change in HIR in the past six years. To ensure these lists were not littered with outliers and oddities, we applied a few filters to both income and population.6

Nine states are represented on this list, but only one state is included more than once. California dominates with twelve Counties on the list. A handful of locations on this list were once considered “affordable alternatives” to more populated and higher income metro areas but can no longer be considered ripe for hot deals, namely, Kootenai (ID), Santa Fe (NM), and Island (WA). The combined effects of urban flight and other recent social issues are apparent in surprising increasing affordability in locations such as New York (NY), Marin (CA), and San Mateo (CA). In Marin County (CA) just north of the Golden Gate bridge, for example, a household looking to buy is two years and seven months better off than they were in 2019.

One commonality you may note is the frequency of what would generally be considered “resort” communities. What do Santa Barbara (CA), Monroe (FL), and Kootenai (ID) have in common? Whether mountains, oceanside, or National Parks, these are spread across the country in “high amenity” areas. Not surprisingly, many of these locations have dealt with similar struggles in terms of short-term rental, ADU rentals, and other such issues.7

HIR Results: Most Affordable Counties

If you are looking for a place to move in the US where you can land a living wage job, afford a home, and not live in the middle of nowhere, here is your list. Not surprisingly, most of the communities on this list are near a large to mid-sized metro area but not in that metro per se. Textbook examples include places such as Mentor in Lake County (OH) and Yukon in Canadian County (OK). Both are just a hop skip and a jump from Cleveland (OH) and Oklahoma City (OK), respectively. Most counties are also in the previously noted middle of the country, mainly in the states of Ohio, Illinois, Missouri and Texas. Just as Table 3 features a high number of Counties trending more affordable, the “deals” available in these Counties are becoming more scarce, evidenced by trends in places such as Gloucester County (NJ), Kendall County (IL), and Camden County (NJ) which each experienced a 40%+ increase in HIR.

Table 3: Least Affordable Counties to Buy a Home in 2025

| County Name | 2025 HIR | HIR Change |

|---|---|---|

| Santa Barbara County, CA | 20.15 | 3.21 |

| Monterey County, CA | 13.91 | (0.37) |

| New York County, NY | 13.77 | (4.36) |

| Monroe County, FL | 12.72 | 1.24 |

| Orange County, CA | 12.26 | 3.03 |

| Newport County, RI | 11.86 | 4.63 |

| Santa Cruz County, CA | 11.73 | 1.14 |

| Napa County, CA | 11.68 | 1.37 |

| Maui County, HI | 11.57 | (0.01) |

| Los Angeles County, CA | 11.29 | 0.31 |

| San Luis Obispo County, CA | 11.17 | 1.67 |

| Marin County, CA | 10.55 | (2.57) |

| Barnstable County, MA | 10.41 | 3.49 |

| San Mateo County, CA | 9.45 | (2.09) |

| Kootenai County, ID | 9.17 | (2.16) |

| Santa Fe County, NM | 9.12 | (0.41) |

| Sonoma County, CA | 9.03 | 0.18 |

| Island County, WA | 8.95 | 2.19 |

| Suffolk County, MA | 8.91 | (1.35) |

| San Diego County, CA | 8.86 | 0.40 |

Source: Points Consulting, HIR 2025

Table 4: Most Affordable Counties to Buy a Home in 2025

| County Name | 2025 HIR | HIR Change |

|---|---|---|

| St. Louis County, MO | 2.96 | (0.90) |

| Hancock County, OH | 3.33 | 0.04 |

| Lake County, OH | 3.43 | 0.32 |

| Miami County, OH | 3.52 | (0.41) |

| Canadian County, OK | 3.52 | 0.47 |

| Guadalupe County, TX | 3.58 | 0.17 |

| Will County, IL | 3.64 | 0.46 |

| Brazoria County, TX | 3.67 | 0.32 |

| Gloucester County, NJ | 3.67 | 1.26 |

| Kendall County, IL | 3.71 | 1.11 |

| Fairbanks North Star Borough, AK | 3.72 | 0.61 |

| Boone County, KY | 3.73 | (0.33) |

| Sherburne County, MN | 3.74 | 0.60 |

| Johnson County, IN | 3.74 | 0.13 |

| Hunt County, TX | 3.74 | (0.17) |

| Sussex County, NJ | 3.76 | 0.96 |

| Jefferson County, MO | 3.76 | 0.47 |

| Charles County, MD | 3.81 | 0.38 |

| Kenton County, KY | 3.81 | 0.36 |

| Camden County, NJ | 3.82 | 1.11 |

Source: Points Consulting, HIR 2025

A Note on Methodology

I know, I know, who wants to read a newsletter that has a methodology section. Well, I’d hazard if you follow Points Consulting, you may be one of those chosen few. Our sources for this metric are as follows:

- Median Home Value: Realtor.com. To ensure that we didn’t catch any really high or really low months we looked at a 6 month period. For the 2025 value that is May through October, and for 2019 it is July through December.

- Median Household Income: US Census 1-year ACS for counties with population greater than 65,000; Esri Business Analyst for other counties (2025); U.S. Census SAIPE for other counties (2019).

This analysis includes 3,085 counties and county equivalents out of the total 3,144 in the 50 States. Some counties we were unable to analyze due to lack of home sales data, mostly due to smaller populations and/or lack of home sales taking place in the county during the analysis periods. Connecticut is also missing from this analysis due to a lack of congruency in data reporting from 2019 to 2025. In 2022, the U.S. Census Bureau switched from using counties in Connecticut to using county equivalents which do not correlate in their geographic areas making a comparison from 2019 to 2025 beyond the scope of this analysis.

Endnotes

- Certain geographies were not amenable to this analysis either due to geographic quirks (such as Connecticut) or very small sample sizes.

- Some names of regions have been changed to make them more intuitive to the reader.

- Counties were restricted to areas with population greater than 75K and median household income greater than the 2025 US median of $81,624.

- 2025 Median Income for these regions was determined by a weighted average of all counties in each region based on population size.

- Montana BBER, https://www.bber.umt.edu/pubs/econ/YellowstoneTourism-Impact2023.pdf.

- Counties were restricted to areas with population greater than 75K and median household income greater than the 2025 US median of $81,624.

- Alvarez, Cassandra. “Are Short-Term Rentals Still Driving Up Housing Costs?” Home Stratosphere, May 7, 2025. https://www.homestratosphere.com/are-short-term-rentals-still-driving-up-housing-costs/.

PC News

Recently Completed Projects

Firestone Central Park Feasibility Study, Town of Firestone (CO)

The PC team partnered with the Town of Firestone, Colorado to conduct a comprehensive feasibility study for the Central Park development. Since 2005, Central Park has grown into the civic heart of Firestone, housing the Library, Police Department, and Town Hall. Building on the community-driven vision established in the 2021 Central Park Conceptual Master Plan, PC’s work focused on determining the financial viability, sustainability, and long-term community value of transforming the Park into a premier destination. The final report was presented to the Firestone Board of Trustees on November 19, 2025.

Read the full report here: Firestone Central Park Comprehensive Feasibility Study – Points Consulting

Ongoing Projects

Rifle Housing Needs Assessment Community Engagement, Town of Rifle (CO)

Chelan Comprehensive Plan Updates and Land Capacity Analysis, City of Chelan (WA) & Anchor QEA

2025 Rhode Island State of Manufacturing Report, Polaris MEP (RI) & Cross Sector Consulting

FFA Strategic Plan Environmental Scan, National FFA Organization & Schunk Moreland Strategies

Fruita Housing Needs Study & Action Plan, City of Fruita (CO)

Ridgway & Ouray County Housing Needs Assessment, Town of Ridgway and Ouray County (CO)

Kalispell Parks, Recreation & Open Space, Town of Kalispell (MT) & MTLA

Port of Coos Bay Strategic Business Plan, Port of Coos Bay (OR)

Ketchikan Indian Community Comprehensive Economic Development Strategy (CEDS), Ketchikan Indian Community (AK)

City of Cheney Comprehensive Plan, City of Cheney Planning Department (WA) & Nexus Planning Services

Douglas County Comprehensive Plan Update, Douglas County (WA) & Anchor QEA

Places We've Been This Month

PC travelled to Colorado this month for four days of meetings in five cities!

City of Grand Junction, CO

Members of the team were stationed in Grand Junction, Colorado from 11/17-11/20 for various on-site activities.

City of Rifle, CO

Brian and Carson presented in Rifle, Colorado for an official community rollout of our finalized housing needs assessment for the City of Rifle, Rooted in Rifle: Housing Study & Action Plan. In the evening, the city hosted a “Plan Jam” to release results from two other local planning projects as well.

City of Firestone, CO

Brian and Dylan stopped in Firestone to present our findings for the feasibility of the new Central Park development. The park is currently planned to host a variety of facilities including an Athletic Center, USL Stadium, retail opportunities, and municipal buildings. Our trip there was a presentation to the board of directors and interested citizens about our findings.

City of Fruita, CO

Carson stopped by the City of Fruita, Colorado to meet with our client and discuss our ongoing joint housing needs assessment and housing action plan for the city.

City of Ridgway, CO

Brian and Carson presented in the Town of Ridgway, Colorado to members of Town Council and Planning Commission, along with members of the Board of County Commissioners and Planning Commission from the Town of Ridgway and Ouray County. The presentation highlighted key findings and our recommendations from the housing needs assessment for the Town and County.

Interesting Finds

America’s huge mortgage market is slowly dying – The Economist How the next president can solve America’s housing crisis – Economic Innovation Group – Adam Ozimek and John Lettieri New law cuts red tape and boosts opportunities for Texas food trucks – Donnie Tuggle Portland’s Long Fall Toward Hitting Bottom – Eric Fruits |